Pre-Need Funeral Plans: A Complete Guide to Planning Ahead

What Is Cremation? Understanding the Process, Meaning, and Memorial Options

November 13, 2025

Funeral Planning Guide: Everything You Need to Know

November 20, 2025Thinking about funeral arrangements ahead of time isn’t something most of us look forward to, but it can be one of the kindest gifts you leave for your family. Pre-need funeral plans make it possible to make personal choices now, at your own pace, without pressure or emotional stress. Instead of leaving your loved ones to guess what you would have wanted, you can outline everything in advance and even lock in today’s price.

This guide walks you through what these plans are, why people choose them, and how pre-planning can bring peace of mind long before it’s needed.

What Is a Pre-Need Funeral Plan?

Pre arranged funeral plans are basically a way to make your funeral arrangements in advance. Instead of leaving all the decisions to your family later on, you can choose what you want now. There’s no rush, no pressure, and no emotional difficulties. Many people include this in their end-of-life planning so their loved ones don’t have to guess about their wishes or worry about unexpected costs.

What is a pre-need funeral plan?! This process is pretty straightforward. You meet with a funeral home, talk through your preferences, and pick the services that feel right for you. After that, the funeral home puts everything into a written agreement that explains what’s covered and how much it will cost.

You can pay for the plan in full or spread the cost out over time. The money is usually kept in a trust or connected to funeral insurance or burial insurance, so it’s protected and will be used exactly for what you planned.

A pre-need plan can cover a lot of different things, depending on what you choose. Most people include:

- A casket or cremation urn

- The type of funeral or memorial service they want

- Viewing or visitation arrangements

- Transportation for the deceased

- Burial or cremation expenses

- Cemetery fees or graveside services

- The funeral director’s professional services

Some pre arranged funeral plans also let you add some personal touches, like music, readings, or special requests, so your family knows exactly how you want your life to be remembered. And if your wishes change later, most plans can be adjusted.

Types of Pre-Need Funeral Plans

Guaranteed vs. Non-Guaranteed Plans

A guaranteed plan means the funeral home locks in today’s prices for the items and services you choose. So even if costs go up over the years, your family won’t have to pay the difference later. This is one of the biggest benefits of pre-need plans, especially with rising prices for services, caskets, and other funeral essentials.

People often choose guaranteed plans because they want cost certainty and don’t want their loved ones to face unexpected expenses.

A non-guaranteed plan still lets you make a selection ahead of time, but the prices aren’t fixed. This means your family may need to pay the difference if costs increase in the future. The plan still outlines your wishes and helps avoid emotional decision-making, but it doesn’t offer the same financial protection as a guaranteed plan.

Non-guaranteed funeral plan options can work for people who want flexibility or who aren’t ready to commit to locked-in pricing.

Funeral Home Prepaid Plans

Many people choose to work directly with a funeral home when setting up a prepaid plan. This option is very simple – you decide what kind of service you want, and then you pay for those choices ahead of time. You can pay everything upfront or split the cost into monthly payments, depending on what feels comfortable for you. It’s an easy way to manage the cost of pre-need funeral plans while making sure your wishes are clearly laid out.

Funeral homes usually offer several funeral plan options, from basic services to full traditional funerals or cremation packages. You can pick whatever fits your preferences and budget. Once you make your selections, the funeral home puts everything into a written agreement so you know exactly what’s covered. Most prepaid plans are backed by a trust or an insurance policy, which helps keep your money safe until it’s needed.

People often choose prepaid plans because they remove a lot of worry. Your family won’t have to make stressful decisions later, and they won’t be surprised by unexpected costs. Everything is already arranged, paid for, and explained for everyone.

Final Expense / Burial Insurance

Final expense or burial insurance is another way to plan ahead. It helps cover funeral and burial costs so your family doesn’t have to pay out of pocket. You pay small regular premiums, and when the time comes, the money goes to your loved ones or the funeral home.

This type of funeral insurance is flexible. Unlike pre-paid plans, it doesn’t tie you to a specific funeral home or package, but it still makes sure the money is there when needed. Many people use burial insurance alongside funeral pre-planning so both the money and the arrangements are taken care of in advance.

It’s a simple way to give your family peace of mind and let them focus on remembering you, not worrying about costs.

Trust-Funded Plans

A trust-funded plan is a way to prepay for your funeral while keeping your money safe. When you create this type of plan, the funds you pay are placed in a trust account, which is used only for the funeral services you’ve selected. This gives you confidence that your wishes will be carried out exactly as planned.

One of the biggest advantages of a trust-funded plan is security. The money is protected and often grows after some time, which helps to keep up with rising funeral costs. It also takes the financial burden off your family, so they don’t have to worry about paying for anything when the time comes.

People often choose trust-funded plans because they combine peace of mind with practicality. Your arrangements are considered, the funds are safe, and your loved ones can focus on honoring your memory instead of handling payments or logistics.

Simple Pre-Arrangements Without Payment

Not everyone wants to pay for their funeral in advance, and that’s okay. Some funeral homes offer simple pre-arrangements without payment, which let you make all the decisions without putting down any money. You can choose your service type, casket or urn, music, readings, and other personal preferences. This will all be documented so your family knows your wishes.

Such plans are helpful because they remove the stress of decision-making from your loved ones. Even though the costs aren’t prepaid, having everything planned means your family won’t have to guess what you would have wanted. It’s a very practical way to handle funeral pre-planning without committing financially right away.

What’s Usually Included in a Pre-Need Plan?

A pre-need funeral planning can cover many parts of a funeral, depending on what you choose. Most plans include the essentials, along with a few options you can personalize. Here’s what’s typically part of it:

Professional services – these include the work handled by the funeral director and staff, like planning the service, preparing paperwork, coordinating with the cemetery or crematory, and guiding your family through each step. It’s the behind-the-scenes support that helps everything run smoothly.

Visitation and ceremony – if you want a viewing, visitation, or a memorial service, those details can be added to your plan. You can also choose the style of ceremony you prefer, whether it’s religious, traditional, or something simpler and intimate.

Casket or urn – most pre-need plans allow you to choose a casket or urn in advance. When you pick these items early, it will avoid your family having difficult decisions later and make sure you get something that fits your preferences and budget.

Transportation – this covers the transfer of the deceased, usually from the place of passing to the funeral home, and then to the cemetery or crematory. It’s included so your family doesn’t have to make the last-minute arrangements.

Burial plot or cremation arrangements – if you plan to be buried, you can select a burial plot or outline where you’d like to be laid to rest. For cremation, the plan can include the cremation service, urn selection, and instructions for the final placement of your ashes.

Documentations and permits – funeral homes also handle all necessary paperwork, such as death certificates and permits. Including this in your plan takes a lot of stress off your family during an already overwhelming time.

Benefits of Pre-Need Funeral Plans

- Financial protection against rising costs – one of the biggest advantages is being able to lock in today’s prices. With a pre-need plan, you’re protecting your family from higher costs in the future.

- Reduces emotional burden on family – planning also lifts a lot of pressure off your loved ones. They won’t have to make tough decisions during an already painful time.

- Ensures personal wishes are followed – your choices are clearly written down, so your family knows exactly what you wanted – no confusion, no guessing.

- Flexible payment options – whether you prefer to pay everything at once or spread it out over time, most funeral homes offer options that fit different budgets.

- Peace of mind – in the end, pre-planning brings a sense of calm. You know things are handled, and your family knows they won’t face extra stress later.

Costs of Pre-Need Funeral Plans

The cost of pre-need funeral plans can vary a lot, but most fall within a few thousand dollars. The final amount depends on the type of service you choose, whether you prefer burial or cremation, and the casket or urn you select. Extras like a viewing, a memorial ceremony, or special arrangements can also raise the price. Even your location matters, since funeral costs are different in places.

It’s also smart to ask about fees that might not show up right away. Some plans have additional charges for things like transportation, paperwork, or cemetery services that aren’t included in the basic package. When you know these in advance, it helps you avoid surprises.

When comparing options, it’s helpful to look at prepaid plans offered by funeral homes and how they differ from funeral insurance or burial insurance. Insurance pays out a set amount later, while prepaid plans usually lock in today’s prices. Comparing the two can make it easier to choose what’s most practical and affordable for your situation.

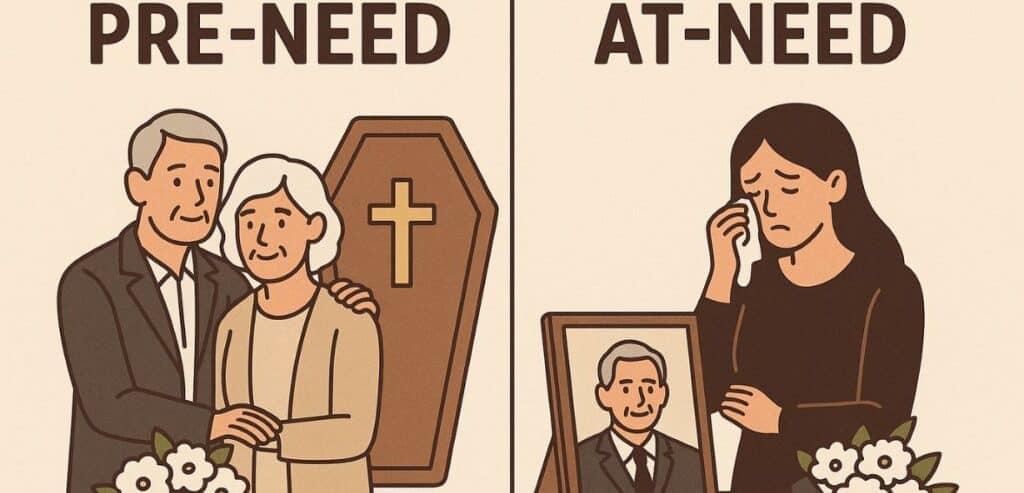

Pre-Need vs At-Need vs Pre-Arranged Plans

Pre-Need

A pre-need plan is set up and paid for in advance. Your choices are written down, the costs are secured, and everything is arranged long before it’s needed.

At-Need

At-need planning happens after someone passes away. The family has to make all the decisions quickly, often while dealing with grief and stress.

Pre-Arranged

A pre-arranged plan lets you record your wishes in advance, but there’s no payment involved. The decisions are made early, but the costs are handled later by your family.

| Plan Type | When it’s made | Payments status | Main benefit | Typical drawback |

Pre-Need | Before death | Paid fully or through installments | Secures today’s prices and reduces family stress | Requires upfront or ongoing payments |

At-Need | At the time of death | Paid immediately by the family | Choices made based on immediate needs | Most stressful and often most expensive option |

Pre-Arranged | Before death | No payment made in advance | Wishes are documented clearly | The family must cover all costs later. |

How to Choose the Right Pre-Need Funeral Plan

When comparing funeral plan options, start by asking the funeral home clear questions about what their prepaid funeral plans include and how the payments are handled. It also helps to learn how to choose a funeral home – look for experience, transparency, and good reviews so you feel confident in your choice.

Always read the contract carefully. Make sure the services are listed clearly, prices are explained, and you understand whether the plan is guaranteed or non-guaranteed. Double-check the refund and cancellation rules so you know what happens if you change your mind later.

If you think you may move, ask about portability. Some plans can be transferred to another funeral home, while others cannot, which can affect long-term flexibility.

Also, don’t forget to confirm that the provider is licensed and follows state regulations. This protects your money and makes sure pre-need funeral planning is handled properly.

Common Misconceptions About Pre-Need Funeral Plans

Paid plans cover everything – not all costs are included. Some plans cover only basic services, while flowers, upgraded caskets, or cemetery fees may be additional. Always check what’s included.

You can’t change your plan later – most plans can be updated if your wishes or circumstances change. Flexibility is usually allowed, just confirm with the provider.

All funeral homes accept any pre-need contract – preneed contracts are often tied to a specific funeral home. If you move or want a different provider, the plan may not transfer. Check portability before you sign everything.

Frequently Asked Questions

- Are pre-need plans safe?

Yes, funds are usually protected in a trust or backed by insurance.

- What happens if the funeral home closes?

The money is still available and may be transferable to another licensed provider.

- Can I transfer my plan?

Some plans are portable; others are not. Check before signing.

- Does insurance cover all funeral costs?

Not always. It pays a set amount, but extra costs may apply.